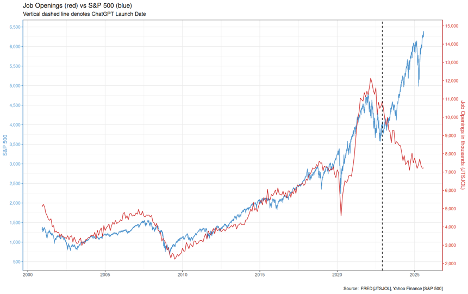

Economic Signals Diverge (S&P 500 vs Job Openings) After Release of ChatGPT

An analysis by Brian E. Moore on November 12, 2025

Release of ChatGPT = dashed line (11/30/2022)

I don't have a crystal ball, but I think I have a knack for spotting emerging trends. AI is fast becoming one of the most disruptive technologies of our time, so it's crucial to stay informed, otherwise you risk getting left behind. As we move closer to the singularity, the time at which AI surpasses human intelligence, every aspect of our daily lives and the way we interact with technology will be fundamentally transformed. Agentic AI, in which AI performs complex tasks on a computer from a simple command, has arrived. For example, I currently use the Comet browser and it has really improved by productivity. With a simple command it will summarize pages of info, draft and send emails, schedule meetings, book reservations, and update my calendar—all seamlessly from within the browser. I highly recommend it.

The real estate business is cyclical. I am always following economic indicators to determine which direction the economy is going, so I can position my properties to succeed. This involves everything from making informed strategies for acquiring and disposing of properties down to how much rent I can charge for an individual unit.

Recently I came across the above graph on social media, that upon first glance, seemed to confirm my primary thesis about AI overtaking jobs. But upon further reflection, it may not be that simple. Here are some of the insights I uncovered as I took a deeper dive into the topic.

ANALYSIS:

The graph shows the S&P 500 turning sharply upwards while job openings are in decline after the introduction of ChatCPT—the first AI large language model—on November 30, 2022. At first glance, this seems to suggest the established correlation between economy and jobs was broken by AI replacing workers while economic growth continues. While this may seem like the most obvious explanation from the graph and from my prior treatise (see AI and the Dawn of Accelerated Productivity: A Vision of Our Bright Future), I have a more nuanced interpretation.

My current view is that AI is increasing productivity but not yet full-replacing workers to the extent of the decline in the job openings. So what is another possible explanation for the divergence?

The S&P 500 is currently dominated by a small group of tech giants whose stocks are being driven higher by investors anticipating AI will eventually revolutionize the workforce and deliver substantial profits.

It's important to note that interest rates began rising in March 2022 (marking the end of the "cheap money" era), with job openings peaking just before the launch of ChatGPT. Throughout the remainder of 2022, the Federal Reserve raised rates by 4.25%. This higher interest rate environment is likely a more significant factor behind the decline in job openings.

Nvidia now comprises 8.1% of the S&P 500's total market capitalization and has soared over 600% since January 2022. While the S&P 500 is up 48% from 2022 to late 2025, an equal-weighted approach—which reduces tech stock dominance—shows an increase of less than 20%.

Currently, the Shiller CAPE Ratio, is at 40.1, indicating that S&P prices are now more disconnected from earnings more than at any period in history except the dot-com bubble (which peaked at 44.2 in December 1999). The 35-year average CAPE Ratio is 27, further highlighting the extent of today's valuation premium.

SUMMARY:

There has traditionally been a strong and rational correlation between U.S. job openings and the performance of the S&P 500. The disconnect observed between these indicators in 2023 appears to be an outlier. I believe this divergence will resolve in one of two ways: either the S&P 500 will undergo a correction (potentially entering a bear market) to align with declining job openings, or AI-driven job replacement will materialize in a significant way—though that scenario likely remains several months or even years away. Both outcomes could occur, especially if large AI companies fail to quickly achieve profitability or if another catalyst triggers a market downturn or recession.